5 Money Lies You Have Been Programmed To Believe

Still broke? It’s not your work ethic, it’s the outdated money lies you still believe. Here are five myths keeping most men financially stuck, and what to do instead.

The lie that keeps on giving

You’ve been lied to.

Not just once, but for decades. In school, at home, even on your government tax forms. From the first paycheck to your last credit card swipe, your relationship with money has been quietly programmed by a system that doesn’t want you to win.

Let’s be real: most men don’t grow up learning how to build wealth. They learn how to survive. Budget. Obey. Work hard. Repeat.

Schools taught you how to memorize irrelevant facts and obey bells. Not how to invest. Not how to build income streams. Not how to negotiate, sell, or protect your assets. And definitely not how to think independently.

That’s not an accident.

Governments benefit when you stay financially dependent. Big corporations thrive when you’re broke but still willing to swipe. And banks? They profit off your debt, not your discipline.

So here you are: working your ass off, playing by the rules, and still struggling. It’s not your fault. But it is now your responsibility.

It’s time to kill the lies and rebuild a system that serves you.

Lie #1: “I just need to work harder.”

This one’s sneaky because it feels right. Your dad probably lived by this motto. Maybe you even respect men who grind 12-hour days like it’s a badge of honor. But here’s the punchline: working harder is often the slowest, least effective way to get ahead financially.

Why? Because you’re still trading time for money. And time is finite.

Working harder makes you tired. Working smarter makes you rich.

Take two men: one works 60 hours a week building someone else’s dream. The other works 20 hours on a business that scales without him. Guess who ends up free?

If you want to build wealth, you need leverage, through scalable systems, digital products, or people. You need to stop being the engine and start being the architect.

Even Warren Buffett said, “If you don’t find a way to make money while you sleep, you’ll work until you die.”

Think about it: how much of your time is actually tied to results? If you stopped working tomorrow, how long would your income last?

Real wealth starts when your money works harder than you do.

Lie #2: “I’m just bad with money.”

This one’s not just a lie, it’s a self-destruct button.

Somewhere along the line, someone told you that you’re just “not good with money.” Maybe it was your parents. Maybe it was your own experience with debt. Either way, you internalized it. And now it’s become a personality trait.

But let’s get something straight: you weren’t born bad with money. You were just never taught how it works.

Do you know what most financially successful men have in common? They didn’t wait to become “good” before they took action. They took responsibility before they felt ready.

The truth is, financial literacy isn’t complicated. It’s mostly about emotional control and consistency. Anyone can learn the basics of cash flow, saving, investing, and asset allocation.

Research from the National Financial Educators Council (NFEC) shows that financial illiteracy cost Americans over $436 billion in 2022 alone. That’s not a skill gap. That’s a crisis of confidence and education.

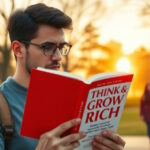

Start with small wins: track your spending, automate savings, read The Psychology of Money, and stop saying you’re “bad with money.” Because you’re not. You’re just untrained.

Lie #3: “Budgeting is the key to getting rich.”

Budgeting is great, for people who want to stay middle class.

Yes, it has its place. Yes, it teaches discipline. But budgeting is about subtraction. Wealth is built through multiplication.

The personal finance world has brainwashed men into believing that if they just stop drinking $5 coffees, they’ll retire rich. But no one gets wealthy by cutting lattes. You get wealthy by increasing income, investing wisely, and controlling where your money flows, not just what you cut out.

Here’s the real game: learn to allocate money based on growth, not guilt.

Wealthy men don’t budget like broke men. They set targets for investing, automate it, and focus the rest of their energy on income creation. They’re less concerned with squeezing pennies and more obsessed with building pipelines.

You don’t become financially free by being frugal. You get there by building machines that produce cash flow while you live your life.

Budgeting alone is financial defense. But if you never play offense, you’ll lose the game anyway.

Lie #4: “High income equals wealth.”

This one ruins men faster than any vice.

You might know a guy who makes $200k a year and still lives paycheck to paycheck. He drives a nice car, wears designer shoes, and has no savings. That man is rich in appearance, and poor in freedom.

Because income isn’t wealth. Net worth is.

Wealth is what you own minus what you owe. It’s what stays when your paycheck stops.

The man making $80k who invests 30% of his income, lives lean, and owns appreciating assets? He’s quietly stacking freedom while the high-earner drowns in lifestyle debt.

High income makes you feel powerful. But it’s a trap if you’re not converting it into assets.

According to the Federal Reserve’s 2023 data, the average net worth of U.S. households in the top 10% exceeds $6.6 million, not because of income, but because of asset ownership. Real estate. Businesses. Index funds. Cash-flowing assets.

The lesson: don’t chase income. Chase ownership. Chase time. Chase peace.

Lie #5: “I can’t afford to invest right now.”

This lie sounds logical, especially when bills are stacked and income feels tight. But here’s what most men don’t realize: investing isn’t about having “extra.” It’s about prioritizing your future self over your present comfort.

If you keep waiting until you’re “ready,” you’ll never start. And the cost of waiting is massive.

Let’s say you start investing $200 a month at age 25. With a 7% average return, you’ll have around $500,000 by age 65. But if you wait until 35? You’ll have less than half that, even if you contribute the same amount.

That’s the power of compound interest. It rewards the early and punishes the hesitant.

Even investing just $10 a week trains your identity. It flips the switch in your brain from “consumer” to “owner.”

There are dozens of investing apps now that make it idiot-proof: Stake, Pearler, Raiz, Sharesies, and others in the Aussie market. No excuses.

You can’t afford to not invest. Every day you delay, you lose money, and time you can never buy back.

The real problem: how you were trained

Here’s what no one tells you: your beliefs about money didn’t come from logic. They came from authority figures, repetition, and outdated systems.

The school system? It trained you to obey, not think. You were rewarded for compliance, not creativity. Taught algebra, not accounting. Memorization, not monetization.

The government? It taxed your income, not your assets, because it benefits when you stay a wage slave. It told you debt is bad, but then hands you student loans like candy. Told you investing is risky, but takes your super and puts it into the stock market without blinking.

Even your parents? They did their best, but most handed you a financial blueprint from a world that no longer exists, one where pensions were guaranteed and jobs were for life.

It’s not your fault. But it is your fight now.

You were trained to survive the 20th century. You need to reprogram yourself to thrive in the 21st.

What to do now?

You’ve read this far because something inside you knows the truth: you’ve outgrown the old money mindset.

The next step isn’t another budgeting app. It’s an identity shift.

Start acting like a man who builds wealth. Track your net worth every month. Learn how investing works. Build systems that run without you. Stop chasing fake financial status and start building real financial power.

If you’re serious, pick one lie from this list and destroy it this week. Not tomorrow. Not when it’s “easier.” This week.

Your future self will either thank you, or resent you.

Choose wisely.

Remember, most broke men aren’t lazy. They just believe outdated stories about how money works. And those stories keep them stuck, tired, resentful, and dependent.

Want out? Start by burning the script. Then write your own.